As the rate of pandemic accelerates, it puts more pressure on financial services firm to remain afloat in the ongoing gloomy times of uncertainty. The investing banking sector not only needs to protect themselves from going obsolete, but has the onus on it to prevent global financial markets go into hopelessness.

Across the globe, the financial firms are putting in their best foot forward in context of saving the economic ecosystem from crumbling down by collaborating with the federal governments.

For keeping themselves alive in the market amid the economic adversities led by the pandemic, banks need to make big adjustments in their business, as well as technology-operation models. Or else, they will fall flat to the prevailing challenges set by the COVID epidemic before them.

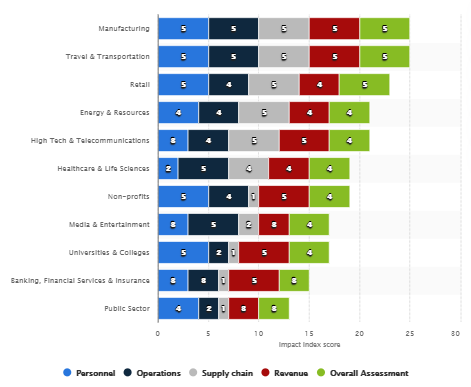

Projected COVID-19 impact index by Industry – Minor (1) to Severe (5)

Source: Statista

Here, we will be discussing about the ‘new normal’ for banking that will follow the end of the crisis, post a few months from now.

What Preventive Measures Banks Should be Taking to Survive the Pandemic?

Turning to Digital

Banks would need to go the digital way to minimize the economic adversities been brought to the industry by the virus. It would be advisable for the investment banking industry across geographies to take their business processes onto cloud. These days, even the students enrol in the investment banking certification programs online over the cloud.

The advent of the Wuhan virus has not only taken the financial trading activity online, but has also made employees submitting their work digitally on the web. This clearly indicates how desperately the banking industry needs to upgrade their technological infrastructure.

It’s only logical that we will see big investments being put into digital innovation at the major investment banks, globally, in the times to come. FinTech sector is all set to see a steep growth very near in the future.

Upliftment in OffShore Technological Capabilities is Much-Needed

A majority of financial services firms rely on offshore support in the departments of technical expertise and operations management. They outsource technical assistance and banking professionals so as to get their work done at reduced costs. However, in the times of the ongoing crisis, lockdown has been imposed in most of the country’s banks used to outsource support from.

Hence, the professionals from the outside countries at the moment, do not have the appropriate resources to continue serving the banks in an optimal capacity. And that is why, there is a dire need to go near-shoring instead of offshoring. By the virtue of receiving services from the nearby regions, you get to swiftly adapt, and respond, to the variances.

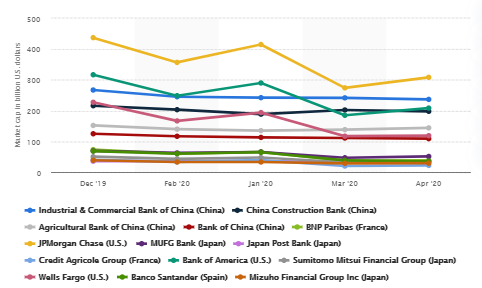

Market Cap of the biggest banks Worldwide Amid Coronavirus Outbreak (Dec. 19 – April 2020)

Source: Statista

Safeguarding Security, Compliance, & Data is Critical

However, WFH policies do help banks save big monetarily by getting rid of the real-estate costs, and the office-operations cost. But, it poses potential threats of the leak of confidential company data, apart from the big fear of cyber-attacks.

Besides, banks cannot allow a large percentage of their employees to work from home. Only, as high as 10-15% of the workforce can be given permission to work remotely. Compliance is another big challenge when you allow a majority of your workforce to deliver work remotely, while being on unprotected networks.

Upkeep of strict control environment for trading is highly challenging when you permit employees in the financial sector to work from their own places. As the personnel get further distributed at investment banks, there will exist a need to take the data, compliance, and security models to employees’ homes in order to safeguard the company proceedings from the prospective hackers.

Concluding Thoughts

Had the investment banking sector been hit by a pandemic as deadly as COVID in 2000 or 2008, most banks would not have survived. It’s the digitization of the financial sector in the recent past that is helping the banks survive the economic downturn this big.

Investment banking firms will continue making adjustments to their respective business models till the time the pandemic lasts. We are destined to see some major restructuring happening in the IT & Technology infrastructure of a majority of banks that have survived the adversities until this day. And rightly so, as it is what will keep them afloat in the even darker times to come.